Key Takeaway

AI and machine learning systems are being adopted by more financial institutions to help immediately detect money laundering schemes and other financial fraud. However, using AI comes with its challenges, which should not be ignored.

Financial crime is a widespread obstacle that has a significant impact on brand value, reputation and goodwill, as well as on the revenue of financial organisations affected. In addition to the risk of losses due to fraud, affected companies face a number of other costs, including cost of compliance, internal crime detection efforts and fines/penalties.

As per the Financial Conduct Authority, British banks spend an estimated GBP 5,000,000,000 annually to fight financial crime. Most of the resources are allocated towards prevention of money laundering. In such circumstances, banks and other financial institutions depend on market innovation that can strengthen Anti-Money-Laundering (AML) processes and significantly reduce the costs of financial crime, especially when it comes to compliance.

How AI can be used to mitigate financial fraud

According to a recent report by McKinsey & Company, AI and machine learning technologies, at their current stage of development, are quite capable of reducing compliance costs by 20-30%. One in every five financial firms have implemented an AI system to fight financial crime.

AI-driven software can analyse vast amounts of transaction data much quicker and more efficiently, in comparison to human counterparts, and spot early signs of serious financial crime.

Looking at ‘Transaction Monitoring’ as an example, AI can help reduce the number of “false positives”, instances that require investigation but not substantive action. These are the primary enemies of AML.

There are some popular AI-powered tools that big banks are now adopting to trigger alerts when suspicious activity takes place. Third party platforms such as QuantaVersa, IBM’s Watson financial services, Palantir, and Thomson Reuters and Bloomberg’s financial regulatory compliance solutions are now being used to alert their clients when potential crime is detected. This is then investigated, and a Suspicious Activity Report is submitted to the government.

Palantir have also developed tools for analysing vast amounts of unstructured data in an effort to protect against fraud in their legal as well as mergers and acquisitionsarms.

QuantaVerse

QuantaVerse is the first financial crime detecting platform with AI solutions that is purpose-built for identifying financial and other crimes through audit investigations.

Utilising its AI Financial Crime Platform, QuantaVerse integrates and filters institutional data and related external data – including public internet data, unstructured deep and dark web data, and government and commercial datasets – to help its customers comply with AML, KYC (Know Your Customer) and FCPA (Foreign Corrupt Practices Act) regulations and to rid their institutions of money laundering and other financial crimes.

“With this new technology, audit departments can look at the entire transaction history of the year to spot anomalies. That not only reduces risks, but also saves these internal audit teams resources and time,”

“The AI service analyzes data it gathers from core accounting, core banking, travel and expense reporting and vendor servicing, trade/export to pinpoint irregularities and anomalous data patterns related to both known and not yet identified financial crime typologies,” McLaughlin explained further.

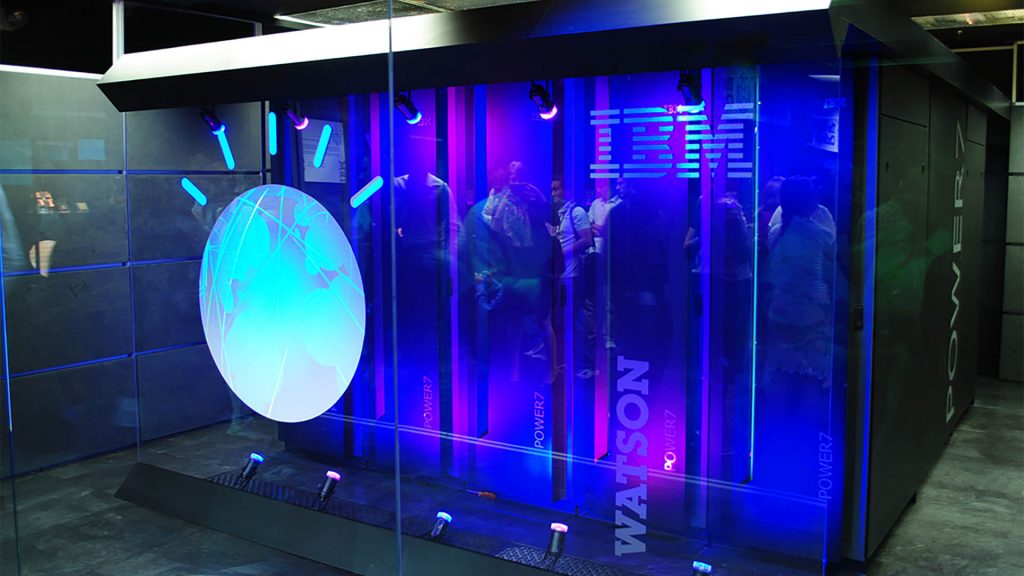

IBM Watson Financial Services

IBM announced plans to acquire Promontory Financial Group, a global market-leading risk management and regulatory compliance consulting firm, in 2016.

This acquisition was an initiative to help financial institutions overcome the challenges of regulatory monitoring, reporting, compliance and risk management while attempting to simultaneously drive down compliance-related costs.

This combination of AI expertise from Watson, and the regulatory expertise of Promontory Financial Group, enables financial organisations to make better informed decisions across end-to-end risk and compliance.

Challenges of adopting AI to fight financial crime

The FCA (Financial Conduct Authority) expects to see AI technology being implemented via testing, governance and proper management. Although these processes are necessary, a recent publication by Allen & Overy points out that they may not be sufficient. AI is dependent on unsupervised machine learning algorithms, which are new to the financial crime space. Firms intending to incorporate AI in their crime detecting efforts need to go beyond just looking at the good practices that put the system in place. The data informing these systems is crucial.

One such challenge is the growing number of false positives.

The increasing number of false positives being generated by AML systems not only increase operational overheads resulting in un-substantive Suspicious Activity Report (SAR) filings, but also potentially result in real alerts going unnoticed under the mountain of false positive alerts.

Cathy Bessant, Chief Operations and Technology Officer at Bank of America, says, “The intent of anti-money-laundering and economic sanctions work is to catch bad guys, so anything that produces a better outcome has to be pursued,” she said. “The reason false positives are a problem is they distract activity away from bad guys. So we have to get better at using data and modeling.”

External data then becomes crucial to enable better decision-making and provide organisations with a bigger picture. Thanks to the initiatives of governments and businesses worldwide, accessing external data is not expensive, and in may instances it’s available for free, and tools like Outside Insight help business leaders extract the valuable insights from this data.