According to PwC, by 2020 there will be 20x more usable data than there is today. Investment managers and funds across the world are beginning to understand the impact that access to new types of data outside a company’s firewalls will have on their ability to make strategic decisions.

Today, external data insights are finding their way into boardroom discussions, resulting in a massive shift in the conversations that take place and giving everyone at the table a more comprehensive, unbiased understanding of real market dynamics before decisions are made.

According to Takehiko Nagumo, managing executive officer at Mitsubishi UFJ Research and Consulting (MURC); formerly executive officer and general manager, corporate data management, Mitsubishi UFJ Financial Group (MUFG) via McKinsey: “Just like any other important matters, we need the board’s backing on data. Data’s existed for a long time, of course, but at the same time, this is a relatively new area. So a clear understanding among the board is the starting point of everything. We provide our board educational sessions, our directors ask questions, and all that further deepens their understanding. And it’s good news, too, that directors are not necessarily internal. They bring external knowledge, which lets us blend the external and the internal into a knowledge base that’s MUFG-specific.”

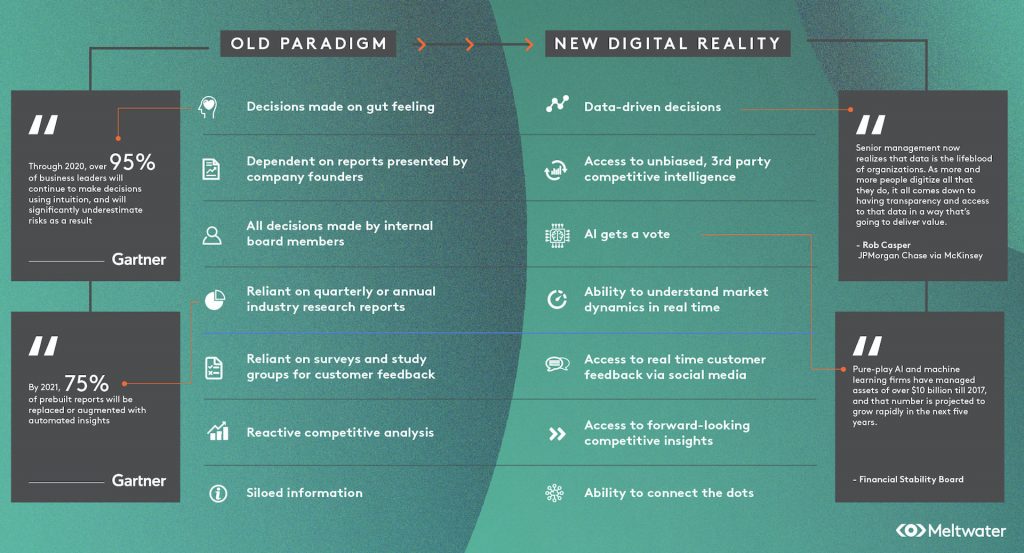

Here’s a look at how the decision-making paradigm will shift when Outside Insight is brought into the boardroom.